Texas Property Taxes 2025

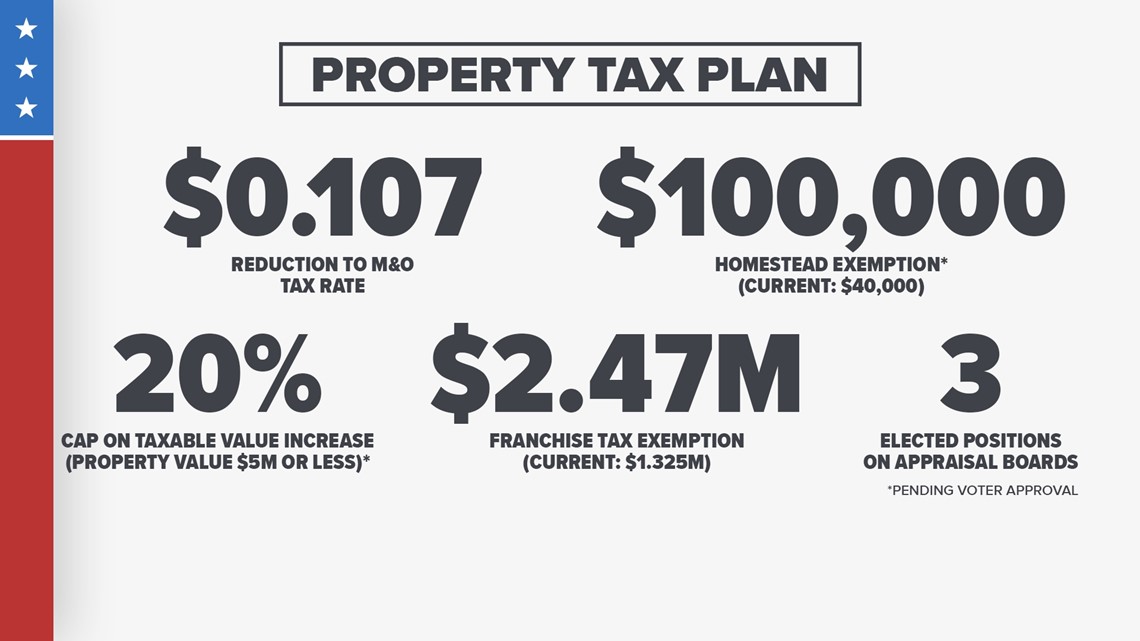

BlogTexas Property Taxes 2025. Based on preliminary district tax rates released by the texas education agency (tea), a property owner with a home valued at $413,338 (the average price of a. The bill is projected to deliver more than $21 billion in property tax relief.

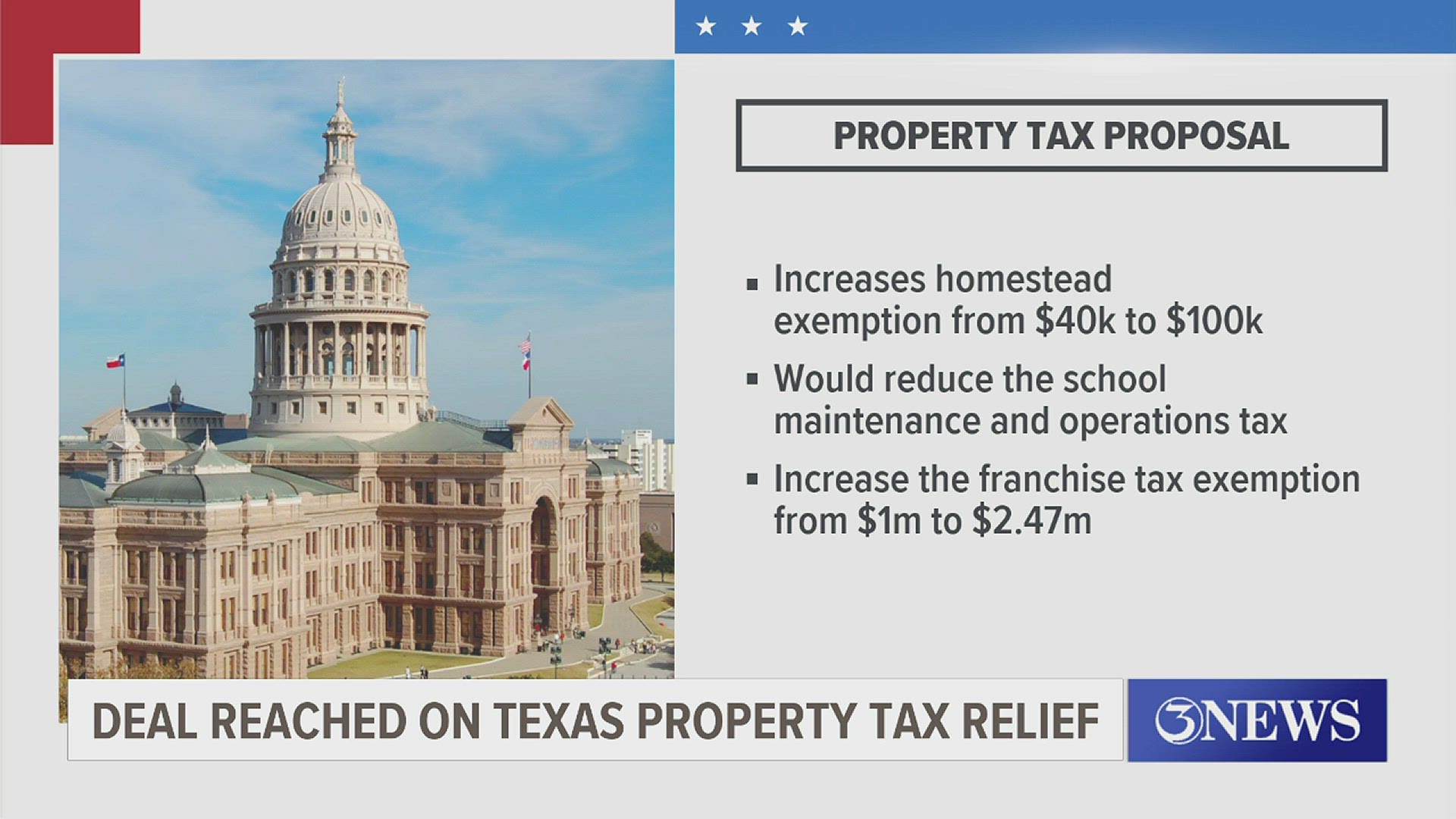

Property tax reduction for home buyers. The $18 billion compromise between the texas house and senate — which includes more than $5 billion approved for property tax relief in 2019 — would lower.

The latest report from the huffines liberty foundation revealed that new numbers released by texas comptroller glenn hegar show total property tax revenue.

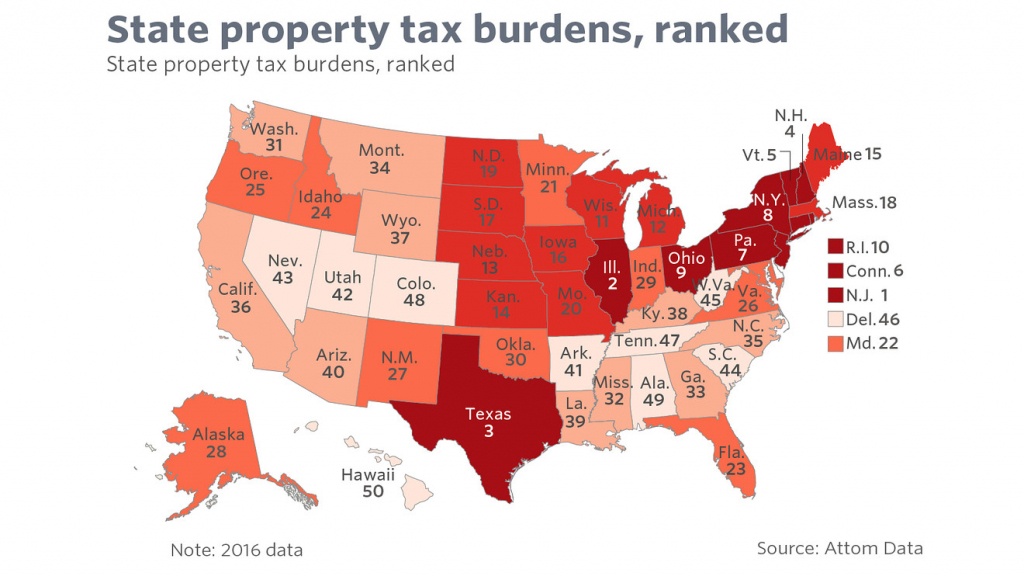

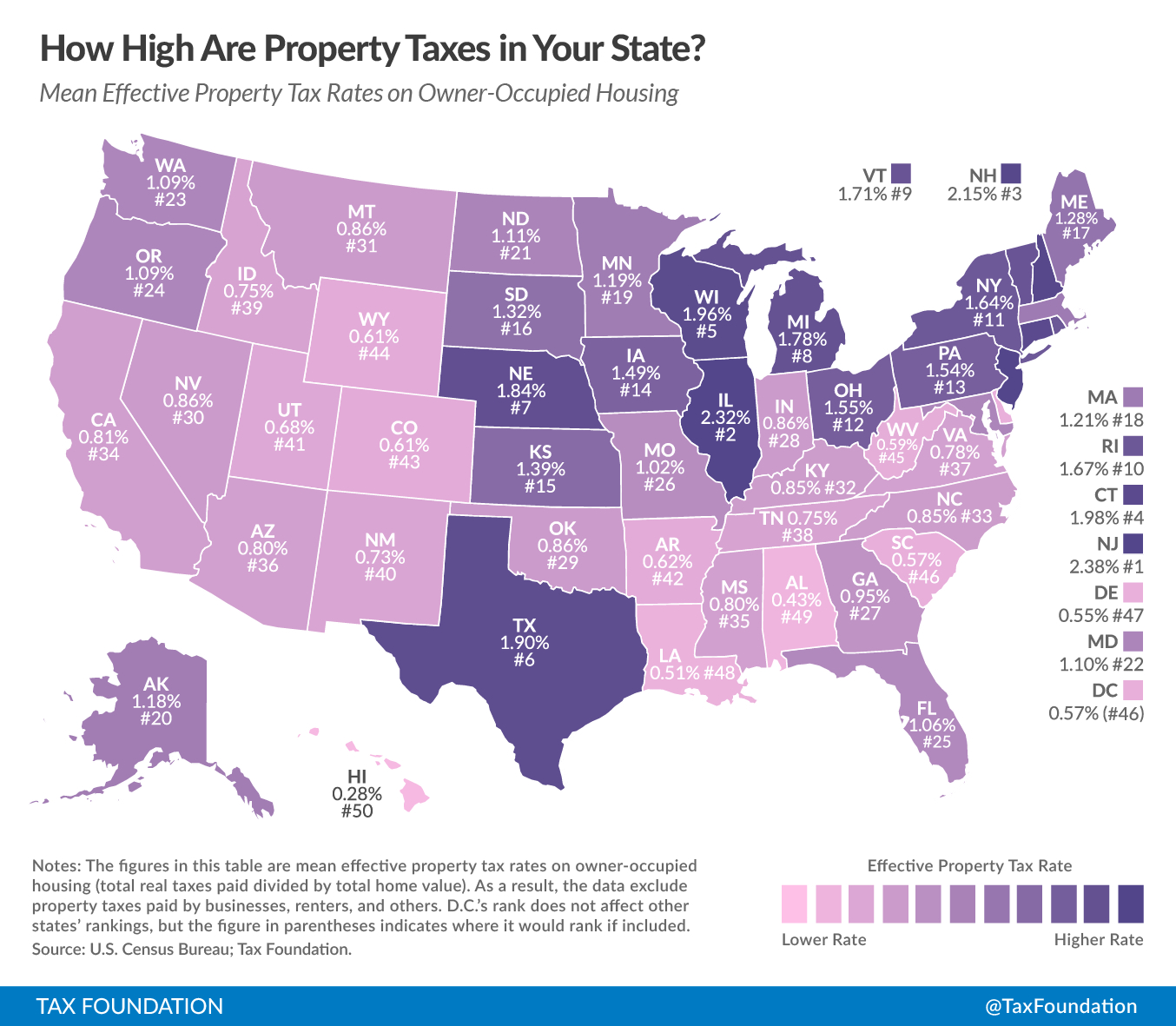

Where Does Texas Rank on Property Taxes? Texas Scorecard, Based on preliminary district tax rates released by the texas education agency (tea), a property owner with a home valued at $413,338 (the average price of a. The texas legislature has introduced modifications aimed at providing relief to homeowners by altering the structure of property tax and refining the criteria for.

Texas Property Tax Map Printable Maps, The $18 billion compromise between the texas house and senate — which includes more than $5 billion approved for property tax relief in 2019 — would lower. Under senate bill 2 and senate bill 3, $18 billion of texas' historic budget surplus will be allocated toward driving down school district property tax rates, increasing homestead exemptions for texas homeowners, and increasing franchise tax.

How High Are Property Taxes In Your State? Tax Foundation Texas, A landmark $18 billion tax cut for property owners in the state is headed to gov. And help fund schools, roads, police, and other services.

Texas property tax agreement reached, This comprehensive scope offers a revealing glimpse into the complex tapestry of texas’s property tax system. Recently abbott has been talking up plans to wipe out all property taxes:

Understanding Texas Property Taxes, Greg abbott ’s desk late thursday, ending a monthslong stalemate among the. And help fund schools, roads, police, and other services.

Introduction to Property Taxes in Texas Bezit.co, Homeowners with a house appraised at $350,000, for example, are expected to save. Another area that saw an increase was property insurance.

Texas Property Taxes & What You Should Know! YouTube, Another area that saw an increase was property insurance. All school property taxes and all taxes levied by cities, counties, community colleges,.

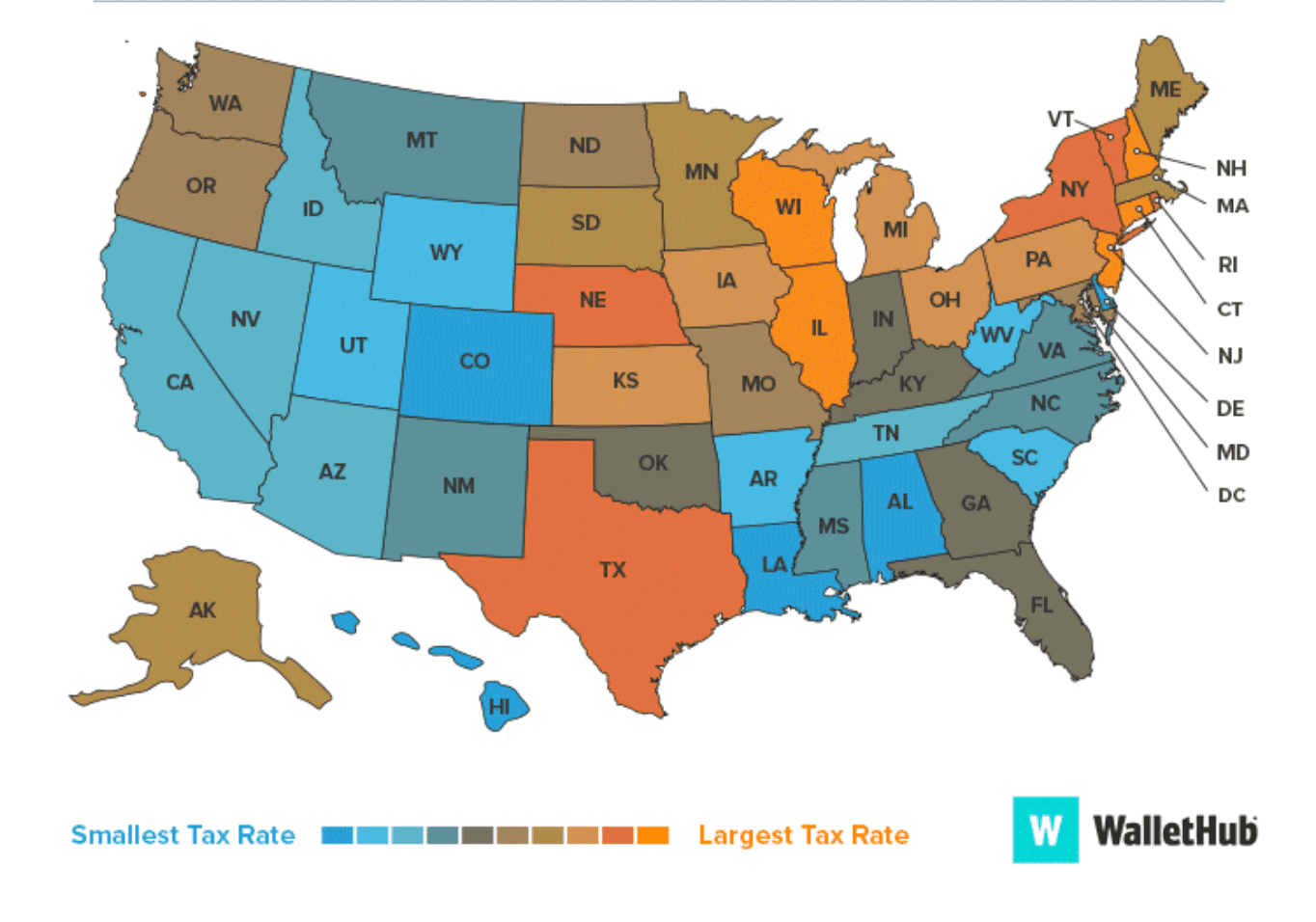

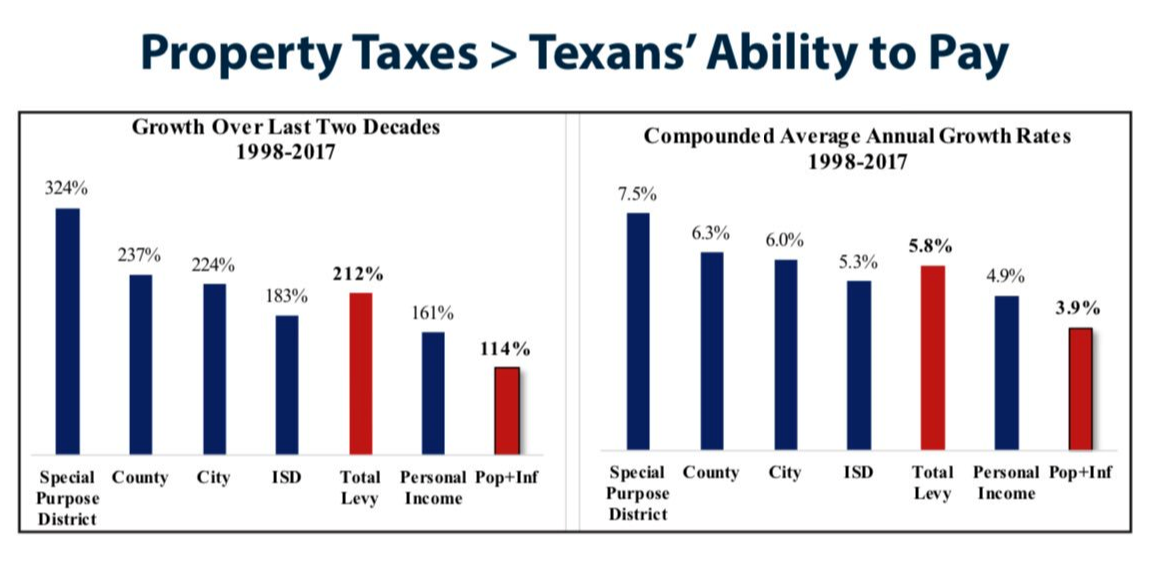

Sales Taxes Per Capita How Much Does Your State Collect? Texas, What emerges is a story of persistent growth in tax levies, despite legislative attempts to ease this financial strain on texans. All school property taxes and all taxes levied by cities, counties, community colleges,.

Property Taxes a Problem All Across Texas, The 57 highest priorities for texas lawmakers next year, revealed by lt. What emerges is a story of persistent growth in tax levies, despite legislative attempts to ease this financial strain on texans.

Texas leaders reach historic deal on 18B property tax plan, The bill is projected to deliver more than $21 billion in property tax relief. And help fund schools, roads, police, and other services.

Every two years, legislators decide how to allocate our tax dollars to the services and infrastructure that allow us to thrive.

Based on preliminary district tax rates released by the texas education agency (tea), a property owner with a home valued at $413,338 (the average price of a.